Navigating Intermodal for the Best Truckload Performance

While intermodal and truckload are similar services, each has strengths that complement one another for a stronger 53' capacity solution. Shippers not looking at these strengths are leaving money and capacity on the table.

The challenge for shippers is to be more strategic in evaluating and constructing their supply chains around both intermodal and truckload.

This blog was written to bring clarity to creating a finely tuned supply chain that utilizes intermodal and truckload strategies that play in concert with one another.

Recognize Intermodal Has a Place

The first step is to recognize intermodal has changed over the past 5 to 10 years making it a strong 53’ solution for shippers. Intermodal is so good that many national asset LTL and truckload carriers use the railroad for their long haul network.

The intermodal renaissance happened with railroads investing heavily in infrastructure, technology, processes and their people. The results brought on-time service, capacity, lane expansion and transits to a point where it is very much a truck like service for both large and small shippers.

The one-stop intermodal providers, often called intermodal marketing companies or IMC’s, shippers no longer arrange origin and destination dray, plus manage the ramp-to-ramp moves with the railroads have also made it much easier for shippers to utilize intermodal for their shipping needs. The IMC’s of today just need the origin and destination addresses and then handle the rest of the details for the shipper.

Reliable and Consistent Capacity

Shippers have been hearing for the last three to five years they need to shore up capacity. To some extent this message has fallen on deaf ears with reality being more of a balanced capacity than a capacity shortage over this period of time. While the transportation economists were off on the timing of the capacity crunch prediction, they are not off on the issue itself. Capacity issues will begin to show itself with a slight uptick in the economy, so now is the time for shippers to shore up capacity and looking at intermodal and truckload together will offer a real solution.

On any given day either truckload or intermodal may have a service issue, which may have shippers shying away from one service or another at one time or another on a particular lane. One bad move does not constitute the service is bad, so shippers need to look at the KPI’s of their carriers over a period of time to ensure they are aligned with industry experts to help navigate issues.

Two areas need to be addressed to ensure the best intermodal service: understand what makes a good intermodal lane and where do intermodal failures tend to occur.

Intermodal starts to make sense for lanes over 600 miles, but with a caveat. The caveat is the length of dray at origin and destination. The shorter the length of haul, the shorter the dray miles need to be. Typically, the most success happens with dray mileage of between 50 to 80 miles, but as the length of haul increases drays over 150 miles on both origin and destination are not unheard of.

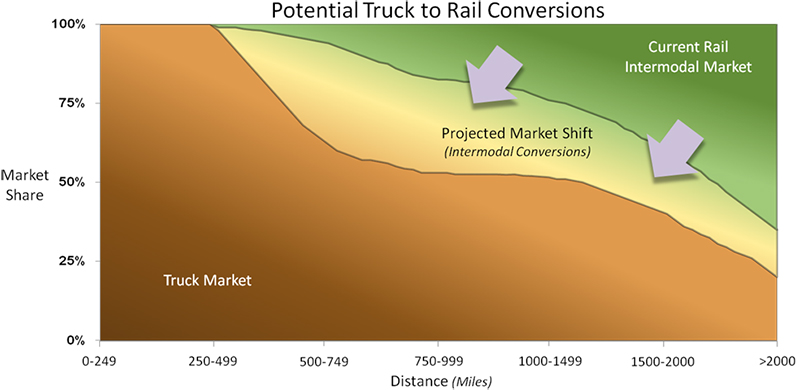

The below graph from the US DOT National Rail Plan illustrates the strength intermodal and truckload have by mileage.

Failures on intermodal tend to happen with the origin or destination dray segment of the move. With that said, the question that needs to be asked during the process of selecting an intermodal provider is what sets their drayage apart from another IMC.

Place the Proof on Concept Burden on Truckload

Here is a new one. Put the proof of concept on truckload.

With the truckload market at $200 billion and intermodal at $10 billion most supply chains will still use more truck than intermodal. An IMC will expedite the decision for shippers as what is a good fit for intermodal and truckload.

In this process, do not shy away from retail shipments. The characteristics of intermodal is a perfect fit for the big box retail market.

Differences to Take into Account

Domestic intermodal and truckload are 53’ services, but there are a couple of key differences:

1. Weight. Domestic intermodal can haul 42,500 pounds, while truckload can haul 45,000.

2. Load Securement. The shipper is responsible to secure intermodal loads, while the driver takes this on for truckload shipments. Under this same subject is blocking and bracing, which is key to any load, but particularly intermodal loads. For more on blocking and bracing, read How to Ship Intermodal without Damage.

3. Transit. Intermodal is typically single drive truck transit plus a day when the intermodal move stays on one railroad. When the lane needs to be completed by interlining to another railroad, the transit can be two to three days slower.

Differences in Asset and Non-Asset Intermodal & Truckload Providers

Asset and non-asset mean different things when talking intermodal and truckload. There are some definite advantages using an asset truckload carrier and using a non-asset truckload broker. The definition of intermodal asset and non-asset has been thrown out in the market to mean the same thing to many shippers, but the reality is asset and non-asset in intermodal is not as easily defined and there are various shades of the concept. With intermodal there is always one part of an intermodal move that is done by a third party. Even the largest of IMC’s do not own the tracks, intermodal well cars, locomotives or intermodal ramps. For more on intermodal providers, read “Defining Asset & Non-Asset Intermodal Providers - Advantages of Both”.

To further the point of asset versus non-asset differences, the truckload market is highly segmented and carriers have access to the same highways as every other carrier. The truckload market is a great fit for non-asset brokers working the capacity, price and service, so it is transparent to the shipper. Within the intermodal market, each railroad has its own network and partners making many of the lanes exclusive to a provider. This exclusivity occurs more times than not, so it is key to tap into an IMC that has access to the entire railroad network. Also, the typical truckload broker has less success with intermodal, unless they have made a serious commitment to the service. A broker using intermodal for just price advantages struggle to provide a great intermodal service for their customers.

Evaluate Advantages and Disadvantages Throughout the Year

There are a couple of points under the topic of evaluating advantages throughout the year:

1. New intermodal ramps continue to be put online, so a lane that was not an intermodal lane last quarter may be an intermodal lane this quarter. This is true for the US, Canada and Mexico lanes, which all fall under the classification of domestic 53’ intermodal.

2. Truckload and intermodal have capacity crunches at different times of the year, which makes some lanes head hauls at one time and backhaul at the other times. Planning and working the lane balance to the shippers advantage pays big dividends in price and capacity.

Not an All or Nothing Proposition

Intermodal for some lanes and truckload for some lanes does not always make sense.

A few examples include: the lane balance issues discussed above; transit sensitive lanes; and the capacity constrained lanes.

On transit sensitive lanes shippers can play the intermodal transit advantage on the weekend where a Thursday and Friday shipment will make delivery on the same day as truck. Another transit strategy is to plan truckload on the critical product, then follow the truck with an intermodal move that arrives a day later.

For capacity tight lanes, intermodal tends to be able to throw more capacity on a lane, so take advantage of the intermodal capacity and augment the lane with truckload.

Summary

A well executed 53’ capacity strategy that engages both intermodal and truckload will save the company money, deliver a better service, put the shipper in a competitive advantage and add capacity.

Article Topics

Integrated Distribution Services News & Resources

Creating Mutually Successful 3PL Partnerships through Systems Integration R2 Freight & Logistics Acquires IDS Transportation Services Rail Still Dominates the Logistics Landscape The Ins and Outs of Intermodal Transportation Why Shippers Need Domestic Intermodal in Their Logistics Strategy U.S. Truck Driver Shortage Elevates Importance of Real Estate in Supply Chain Cost Structures Has Truckload Capacity Improved Since “The Perfect Storm” of 2014 More Integrated Distribution ServicesLatest in Transportation

Talking Supply Chain: Doomsday never arrives for Baltimore bridge collapse impacts Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 Nissan Channels Tesla With Its Latest Manufacturing Process Why are Diesel Prices Climbing Back Over $4 a Gallon? Luxury Car Brands in Limbo After Chinese Company Violates Labor Laws The Three Biggest Challenges Facing Shippers and Carriers in 2024 Supply Chain Stability Index: “Tremendous Improvement” in 2023 More Transportation